Private wireless networks are a hot topic these days, and justifiably so. The market for both LTE and 5G networks worldwide is growing significantly. The number of private networks yet to be deployed dwarf those already installed. What’s interesting in the news is the number of collaborations being done – some by choice, while others are imposed upon vendors by their customers.

Collaborations for private networks’ planning, installation, and operations shouldn’t be a surprise, as the make-up of private networks can differ significantly. Considering the different spectrums that can be involved, the type of network (e.g., all on-site, network slice, shared spectrum), and the various use cases, there are a significant number of permutations. When you factor in the industries that are or will be deploying private networks and the components that can be involved (e.g., core, radios, CPEs, drones), the variations are truly limitless. No one company provides every piece of the private network puzzle. Hence the need for collaboration.

Large companies, such as Samsung, Nokia, and Ericsson, produce many of the network components. However, they are also among the industry leaders in working partnerships; some announced in preparation for anticipated deployments, and others on a project-by-project basis. The latter sometimes depends on geographical familiarity (e.g., Nokia gets business in Finland because of their extensive operations and existing working relationships.)

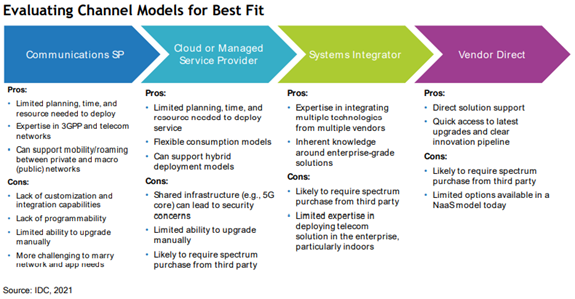

The various types of companies involved in installing and running private networks can be broadly characterized, as seen in the table below from IDC. It succinctly details the advantages and disadvantages of working with different channel partners.

Samsung

Samsung has teamed up with Amdocs, with products in the US for using CBRS for LTE and 5G. Amdocs is one of five FCC-approved vendors running a Spectrum Access System, the database/clearinghouse CBRS devices (CBSDs) communicate with to access the 3.5 GHz band. Fixed Wireless is also in the picture, using CBRS to connect hard-to-reach areas. Samsung and Amdocs have deployed their first campus-wide network at Howard University in Washington, D.C., and plan to deliver more systems across the US in various verticals.

Samsung has announced a partnership with NTT East to provide private 5G networks in Japan for enterprise customers.

Samsung also partners with companies such as Dell, HPE, and Red Hat, in their 5G vRAN ecosystem.

Nokia

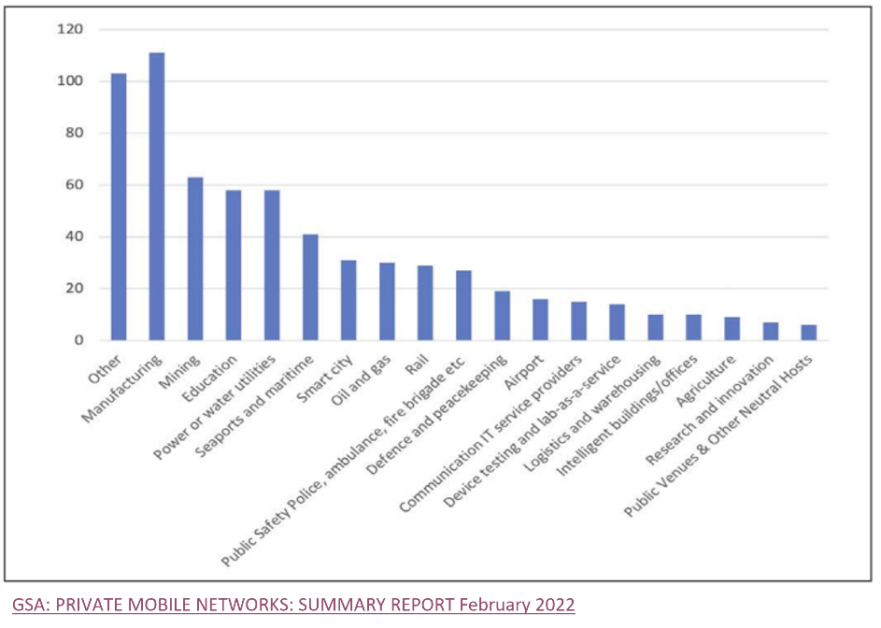

Nokia has been aggressive in partnering to expand its private network reach, making agreements with several companies to further their capabilities for specific verticals. They are partnering with Australian TPG Telcom to develop private networks for the mining and energy sectors, with applications focusing on “…connected workers, connected assets, safe worker and site security, and industrial automation.” Per this GSA chart, mining has the second largest number of identified private networks by sector.

In the education sector, another large user of private networks, Nokia works with partners on an ad hoc basis. They partnered with AggreGateway to provide 4G Fixed Wireless Access (FWA) to students in a rural area of California, and with NetSync in Fresno, California, deploying an LTE CBRS network.

Nokia is collaborating with Digita Oy, a Finnish tower company, to extend Telia’s network across Finland. Together they are testing a 5G SA private network for cargo handling.

They have partnered with Kyndryl, a spinoff from IBM, to help enterprise customers move quickly into private networking. Nokia provides their Digital Automation Cloud (DAC) application platform, while Kyndryl brings consulting, design, implementation, and managed services.

Nokia is also working with Comcast Business, using their DAC and Comcast’s Wi-Fi and IoT solutions. Their first collaboration was at the Wells Fargo Center in Philadelphia.

In Australia, Nokia is partnering with Field Solutions Holdings (FSG), a rural carrier, and Mavenir, who will provide 4G/5G converged packet core and voice and messaging services. The intent is to provide neutral host service in the rural parts of the country and private wireless solutions for agriculture, mining, and government.

Ericsson

Ericsson is another company that makes a wide variety of components for private networks but still needs to collaborate to provide the functionality required by customers. Ericsson is working with Kollmorgen, an industrial manufacturing company, enabling, amongst other things, their Automatic Guided Vehicles (AGVs) to perform more reliably and safer. They have collaborated with Ambra Solutions to produce private networks suitable for underground mines. They first delivered an LTE network three kilometers down a Canadian mine in 2019 and have collaborated on eight underground and open-pit mining deployments.

Ericsson also works with several communication providers, supplying their Private 5G Platform. They are working with Telstra to enable applications such as AGVs, drones, and AR/VR. Their first customer was AgriFood Connect, an Australian not-for-profit company, to help with their agriculture and manufacturing needs. Ericsson is working with Saudi Arabian operator Mobily to provide advanced private wireless networks across various verticals, including manufacturing, mining, and airports.

Cisco

Cisco Private 5G is the California-based company’s “as-a-service” offering, with a pay-per-use model. They are partnering with JMA, Airspan, and DISH Wireless, with an important goal to reduce CapEx for their customers. They intend to easily integrate Ethernet, Wi-Fi, and their IoT Control Center.

Hewlett Packard Enterprises

HPE is working with Airspan and JMA Wireless to deliver “5G in a box”, suitable for deployments in remote locations or as a distributed solution. HPE is combining its private wireless with its Aruba Wi-Fi technology.

Qualcomm

Qualcomm is offering their Private Networks RAN Automation Platform, which “simplifies the deployment and management of RAN for 5G Private Networks”, and partnering with Microsoft, who are providing their Azure private MEC. Their goal, like others, is to shorten the time it takes to deploy private networks. Qualcomm is also working with a series of other partners, including Airspan, Askey, Baicells, Capgemini, Casa Systems, and more.

Qualcomm is also working with Boingo Wireless, looking to simplify IoT deployments. Boingo is providing its CBRS private network solutions to pair with Qualcomm’s IoT services suite.

Microsoft

Microsoft is involved in the background of many public and private networks with its Azure offerings. In a recent demonstration, they worked with Intelsat to successfully test high-performance LTE and 5G services over satellite networks, “virtually anywhere globally, including those in remote and austere environments.”

Celona

Celona has recently announced new partnerships with Verizon Business and Radisys. With Verizon, the offering is aimed at small-to-medium-sized businesses. Celona’s 5G LAN solution coupled with Verizon’s On Site 5G will allow customers to quickly get new networks up and running, integrated with an existing Wi-Fi network. Radisys brings its flexible Connect RAN software to Celona, which is most suitable for shared spectrum deployments.

Pente Networks

Pente Networks is collaborating with Telefonica to bring to market a managed 5G Cloud Service for enterprise use cases. Pente’s packet core solution coupled with Telefonica’s CI/CD platform is intended to reduce service delivery time. David del Val, CEO of Telefonica I+D, said “…we can spin up private networks connected to apps on the cloud edge in hours or days, not weeks or months, and abstracting most of the underlying operational complexity of current 5G networks.

Customer Choice

Many enterprises who need a private network choose the vendors they think best suit their specific needs, with various large and small companies answering the calls.

Sports

- Mobilitie and AEG partner to bring private 5G to the Crypto.com Arena in Los Angeles.

- Edzcom and Nokia at KymiRing, Finland’s largest sports and events venue, are installing a private 5G network.

- Boingo, Cisco, Federated Wireless, and CommScope have deployed a GAA CBRS network in the San Diego Padres Petco Park.

Education

- Cradlepoint and Ruckus Networks joined forces, allowing Utah’s Murray City School District to become the first district in the US to launch its own CBRS Private Network.

- STEPcg, Nokia, and Cambium Networks created an LTE private network in Collinsville, IL, for their school district.

- Newcore Wireless and Nokia are working together to provide private wireless connectivity to remote and underserved Native American communities throughout the US.

Municipalities

- Geoverse and JMA Wireless have deployed a CBRS network across Tucson, AZ.

- Terranet and Baicells deployed a GAA CBRS network in Las Vegas, NV, in 45 days.

Defense

- The US Department of Defense (DoD) is experimenting with spectrum sharing, performing tests at various military bases. In a trial at Hill Air Force Base in Utah, vendors include Nokia, General Dynamics Mission Systems, Booz Allen Hamilton, Key Bridge Wireless, Shared Spectrum Company, and Ericsson.

- The DoD is developing a ‘smart warehouse’ at the Marine Corps Logistics Base in Albany, Georgia, using technology from Federated Wireless, Cisco, JMA Wireless, Vectrus Systems, Perspecta Labs, GE Research, KPMG, and Scientific Research Corp.

Conclusion

Mobile World Congress 2022 saw many private wireless announcements, with companies from A to Z announcing their private network portfolio, from AT&T (working with Microsoft on AT&T Private Edge) to HPE (pay-as-you-go offering) to Qualcomm (Qualcomm Private Networks RAN Automation Platform) to ZTE (all-in-one private 5G network-as-a-service).

AWS made a big splash in November 2021 with their AWS Private 5G solution, intended to be a one-stop shop for companies looking to invest in a private network. Their offering includes core, RAN, and spectrum. While AWS has worked with other vendors in the private wireless arena, they have to date made no announcements about partners in this venture.

With the adoption of open standards, the fall of technology prices, and the acceleration of 5G, we will likely see more collaborations in private networks.Joe Madden of Mobile Experts was quoted recently, “It’s particularly encouraging to see the collaboration between cloud players, system integrators, radio vendors and operators.” He was talking specifically about CBRS deployments, but his words ring true for the entire private network ecosystem.